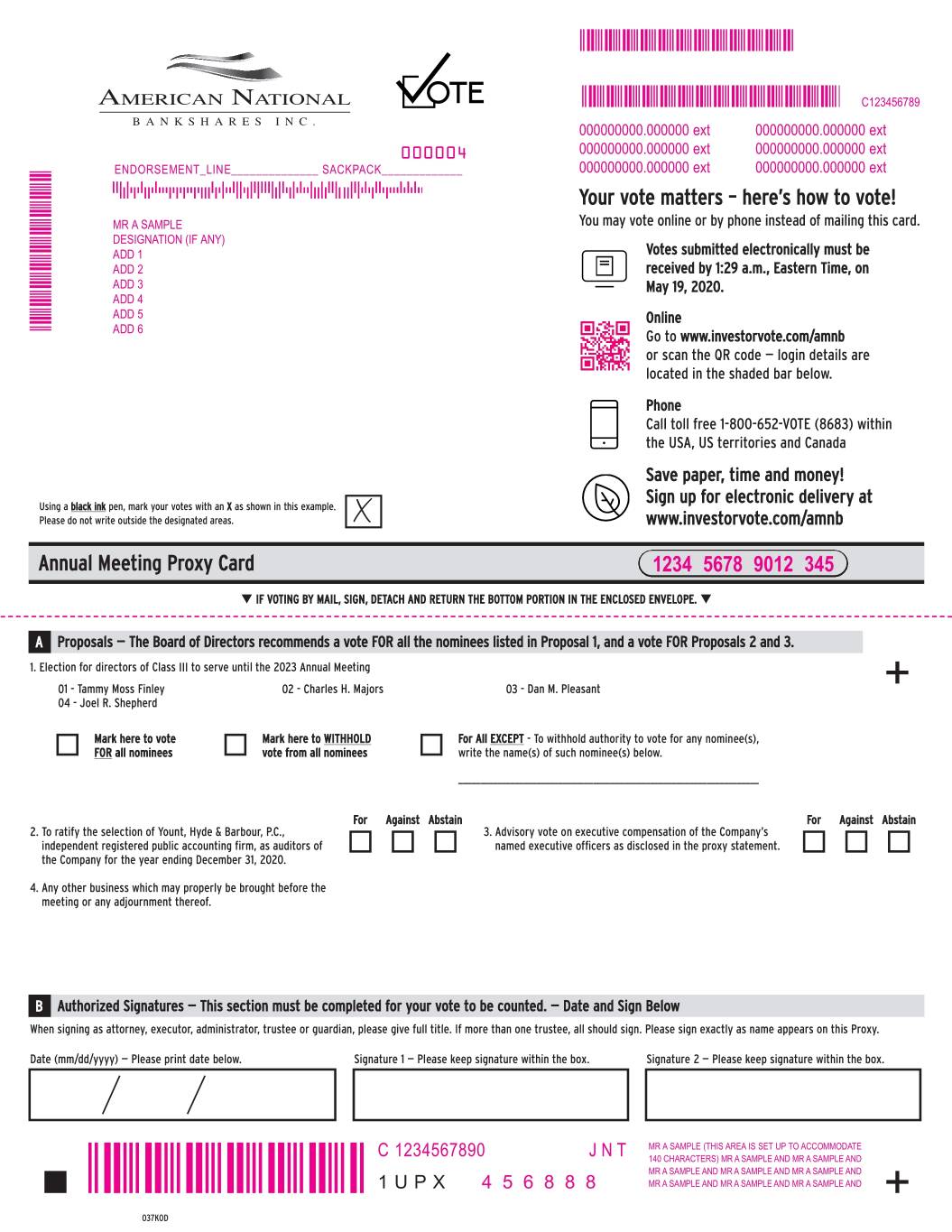

May 19, 202016, 2023

THIS PAGE INTENTIONALLY LEFT BLANK

AMERICAN NATIONAL BANKSHARES INC.

628 Main Street, Danville, Virginia 24541

NOTICE OF ANNUAL MEETING OF SHAREHOLDERS

To be held May 19, 2020

Notice is hereby given that the Annual Meeting of Shareholders of American National Bankshares Inc. (the “Company”) will be held as follows:

| Place: | The Wednesday Club | |

| 1002 Main Street | ||

| Danville, Virginia 24541 | ||

| Date: | May 16, 2023, at 9:00 a.m., Eastern Time. |

The Annual Meeting is being held for the following purposes:

1. | To elect two Class I directors of the Company to serve one-year terms expiring at the 2024 Annual Meeting; to elect one Class II director of the Company to serve a two-year term expiring at the 2025 Annual Meeting; and to elect four Class III directors of the Company to serve three-year terms expiring at the 2026 Annual Meeting. |

2. | To ratify the appointment of Yount, Hyde & Barbour, P.C., independent registered public accounting firm, as auditors of the Company for the year ending December 31, |

3. | To hold an advisory vote on executive compensation of the Company’s named executive officers as disclosed in the accompanying proxy statement. |

4. | To hold an advisory vote on whether an advisory vote on executive compensation should be held every one, two or three years. |

5. | To transact any other business that may properly come before the meeting or any adjournment thereof. |

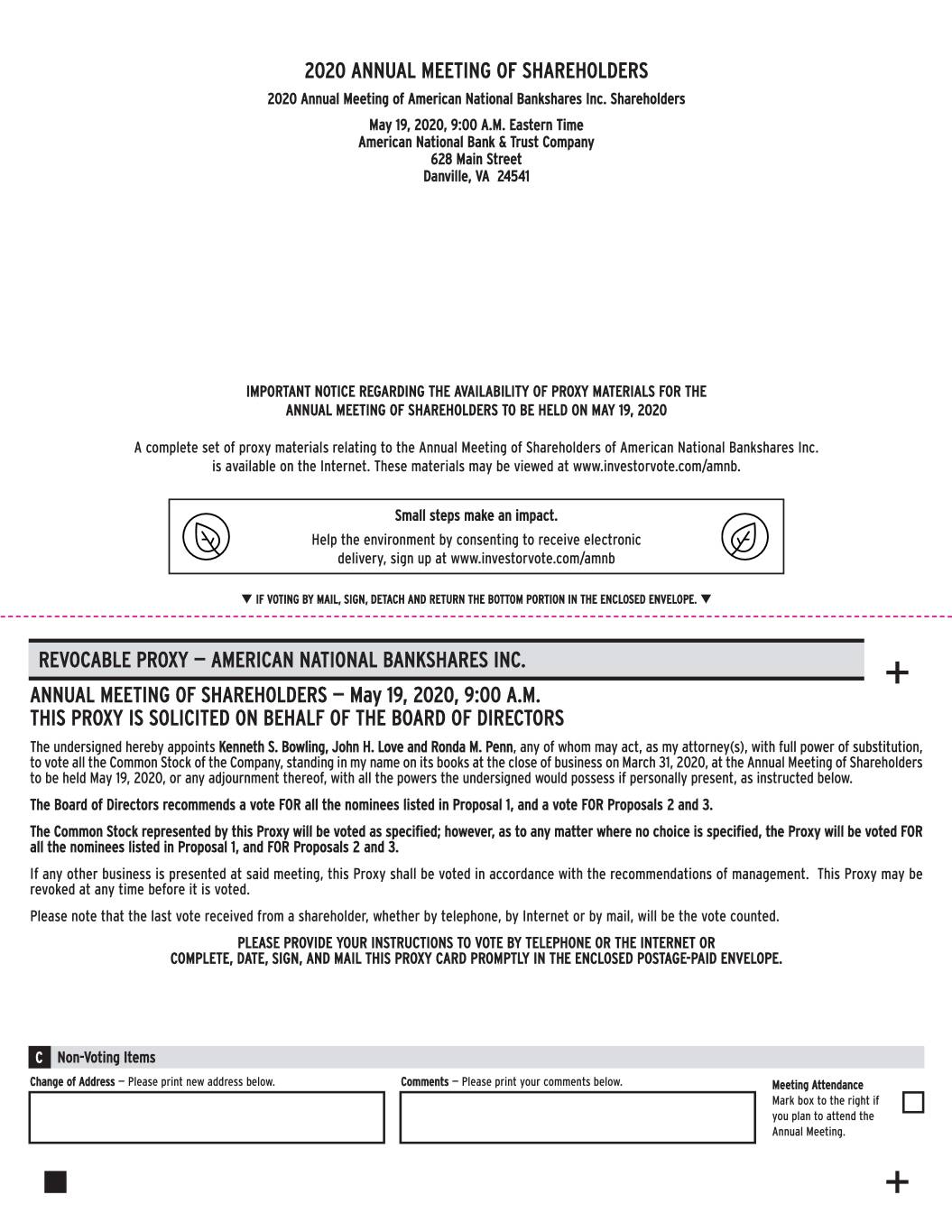

Only shareholders of record at the close of business on March 31, 202028, 2023 are entitled to notice of and to vote at the Annual Meeting.

It is important that your shares are represented at the meeting. Accordingly, please sign, date, and mail the enclosed proxy in the enclosed postage-paid envelope, whether or not you plan to attend. If you do attend the Annual Meeting, you may revoke your proxy and vote your shares in person.

| By Order of the Board of Directors, | |

| |

| Edward C. Martin | |

| Secretary | |

| March 28, 2023 |

THIS PAGE INTENTIONALLY LEFT BLANK

AMERICAN NATIONAL BANKSHARES INC.

PROXY MATERIALS FOR THE STATEMENT

ANNUAL MEETING OF SHAREHOLDERS TO BE HELD ON

MAY 19, 2020

INTRODUCTION

This proxy statement is furnished in conjunction with the solicitation by the Board of Directors (the “Board”) of American National Bankshares Inc. (the “Company”) of the accompanying proxy to be used at the Annual Meeting of Shareholders of the Company (the “Annual Meeting”) and at any adjournment thereof. The meeting will be held on Tuesday, May 19, 2020,16, 2023, 9:00 a.m., Eastern Time, at American National Bank and Trust Company, 628The Wednesday Club, 1002 Main Street, Danville, Virginia 24541, for the purposes set forth below and in the Notice of Annual Meeting of Shareholders. The date of this proxy statement is March 28, 2023, and the approximate mailing date of this proxy statement and the enclosed proxy is April 2, 2020.

Voting Rights of Shareholders

Only shareholders of record at the close of business on March 31, 2020,28, 2023, are entitled to notice of and to vote at the Annual Meeting or any adjournment thereof. As of the close of business on March 31, 2020,28, 2023, there were 10,957,50210,626,066 shares of the Company’s common stock outstanding, of which 10,753,73410,368,974 shares were entitled to vote at the Annual Meeting. For the reasons explained below, the number of shares entitled to vote is less than the number of shares of the Company’s common stock outstanding on such

A majority of the votes entitled to be cast, represented in person or by proxy, will constitute a quorum for the transaction of business. Shares for which the holder has elected to abstain or to withhold the proxy’s authority to vote on a matter will count toward a quorum but will not be included in determining the number of votes cast with respect to such matter.

Shares held by brokers, banks, or other nominees in street name (“broker shares”) that are voted on any matter are included in the quorum. Broker shares that are not voted on any matter will not be included in determining whether a quorum is present.

Ambro and Company, the nominee name that the Company’s banking subsidiary, American National Bank and Trust Company (the “Bank”), uses to register the securities it holds in a fiduciary capacity for customers, held 203,768257,092 shares of the Company’s common stock as sole fiduciary and with sole investment authority (with no qualifying co-fiduciary having been appointed) as of March 31, 2020,28, 2023, which constituted 1.86%2.42% of the issued and outstanding shares of the Company’s common stock on that date. Under Virginia law, such shares cannot be voted at the Annual Meeting and are not deemed to be outstanding and entitled to vote

Voting of Broker Shares

If a beneficial owner of broker shares does not provide the broker, bank or other nominee that holds the shares with specific voting instructions, then under applicable rules, such organization may generally vote on “routine” matters but cannot vote on “non-routine” matters. If the broker or other nominee that holds such shares does not receive instructions from the beneficial owner on how to vote shares on a non-routine matter, that organization will inform the inspector of election that it does not have the authority to vote on this matter with respect to the shares. This is generally referred to as a “broker non-vote.”

The ratification of the appointment of Yount, Hyde & Barbour, P.C. as the Company’s independent registered public accounting firm for 20202023 (Proposal Two) is a matter considered routine under applicable rules. A broker or other nominee may generally vote on routine matters, and therefore no broker non-votes are expected to existoccur in connection with Proposal Two. The election of directors (Proposal One) and, the advisory vote on the Company’s executive compensation (Proposal Three), and the advisory vote on the frequency of executive compensation voting (Proposal Four) are matters considered non-routine under applicable rules. A broker or other nominee cannot vote without

Revocation and Voting of Proxies

Execution of a proxy will not affect a shareholder’s right to attend the Annual Meeting and to vote in person. Any shareholder who has executed and returned a proxy may revoke it by attending the Annual Meeting and requesting to vote in person. A shareholder may also revoke his or her proxy at any time before it is exercised by filing a written notice with the Company or by submitting a proxy bearing a later date. Proxies will extend to, and will be voted at, any adjourned session of the Annual Meeting.

Solicitation of Proxies

The cost of solicitation of proxies will be borne by the Company. Solicitation is being made by mail, and if necessary, may be made in person, by telephone or Internet or special letter by officers and employees of the Company or the Bank, acting on a part-time basis and for no additional compensation.

Reference

A reference in this proxy statement to one gender, masculine or feminine, includes the other; and the singular includes the plural and vice versa unless the context otherwise requires.

PROPOSAL ONE – ELECTION OF DIRECTORS

The Company’s Board of Directors currently consists of 1412 persons. Pursuant to the Company’s Articles of Incorporation, the Board is to be divided into three classes (I, II and III), with each class as nearly equal in number as possible.

The term of office for four current Class III directors, Tammy Moss Finley, Charles H. Majors, Dan M. Pleasant and Joel R. Shepherd, will expire at the Annual Meeting. The four nomineesMs. Finley and Mr. Shepherd have been nominated to continue to serve as Class III directors are set forth below. Allfor three-year terms expiring at the 2026 Annual Meeting. Mr. Pleasant has been nominated to serve as a Class II director for a two-year term expiring at the 2025 Annual Meeting. The Board of Directors, upon recommendation of the nominees currentlyCorporate Governance and Nominating Committee, approved an exception to the Directors’ Tenure Policy to allow Mr. Pleasant to continue to serve, as directors ofbut placed him in Class II so that his new term is two years rather than three years. Mr. Majors, the Company. Continuing memberscurrent Chair of the Board of Directors are also set forth below.

Mr. Charles S. Harris served as a Class I director until his retirement,death on December 7, 2022. Mr. Owen will be eligible to beHarris had served as a Director Emeritus,director since 2008 and was a member of the Company’s Audit Committee and the Board of Directors, upon recommendation from its Corporate GovernanceRisk and Nominating Committee, intendsCompliance Committee.

J. Nathan Duggins III and William J. Farrell II were appointed to appoint him as such for the period May 19, 2020 until May 18, 2021. Mr. Owen, age 74, is retired Chairman and Chief Executive Officer of DIMON Incorporated (leaf tobacco dealer), Danville, Virginia.

The Board of Directors, upon recommendation of the Corporate Governance and Nominating Committee, has nominated Rickey J. Barker and an affirmative finding that such exception is inAdrian T. Smith to serve as Class I directors for one-year terms expiring at the best interest2024 Annual Meeting. Messrs. Barker and Smith do not currently serve as directors of the Company and the Bank, has nominated Charles H. Majors for one additional three-year term as a Class III director. Mr. Majors, age 74, currently serves as Chairman of the Board of the Company and the Bank.

The persons named in the accompanying proxy will vote for the election of the nominees named below unless authority is withheld. If for any reason the persons named as nominees below should become unavailable to serve, an event that management does not anticipate, proxies will be voted for such other persons as the Board of Directors may designate.

The Board of Directors recommends the nominees, as set forth below, for election. The Board of Directors recommends that shareholders vote FOR these nominees. The election of each nominee requires the affirmative vote of a plurality of the shares of the Company’s common stock cast in the election of directors.

The names of the nominees for election and the other continuing members of the Board of Directors, their principal occupations and qualifications to serve as directors, their ages as of December 31, 2019,March 28, 2023, and certain other information with respect to such persons are as follows:

Name | Principal Occupation | Age | Director Since |

Nominees for election as Class I directors to serve until 2024 (Proposal One)

| |||

Rickey J. Barker | President, Supply Resources, Inc. (tailor-made packaging provider), Danville, VA since 2007.

Mr. Barker brings extensive experience from multiple industries. His entrepreneurial, construction, finance and real estate knowledge, as well as leadership and strategic planning skills, are expected to enhance the quality of the Board. He has been instrumental in economic development within the Danville, Virginia region. He also served on the Company’s Virginia State Banking Board.

| 62 | N/A |

Adrian T. Smith | President and Chief Executive Officer, Ice Management, Inc. (McDonald’s franchises), Greensboro, NC since 2004.

Mr. Smith brings a diverse perspective combining extensive operational and financial knowledge as well as strategic planning expertise from his experience as owner of a large restaurant organization. He also served on the Company’s North Carolina State Banking Board.

| 50 | N/A |

Nominee for election as Class II director to serve until 2025 (Proposal One)

| |||

Dan M. Pleasant | Senior Consultant, The Dewberry Companies, Inc. (engineering, architectural and consulting), Fairfax, VA from April 2022 until April 2023. Managing Member of DMP Consulting PLLC (consulting to the engineering and architecture industry) beginning May 2023. Retired Chief Operating Officer, The Dewberry Companies, Inc. from April 2010 to March 2022.

Mr. Pleasant brings significant experience as a professional engineer working in the Company’s market areas in Virginia and North Carolina. In addition, until his retirement in 2022, he was the Chief Operating Officer of a large national architectural, engineering and consulting firm, leading the firm’s merger and acquisition program. He is the immediate Past Chair of the Board of the Virginia Economic Development Partnership and served as director of the Virginia Chamber of Commerce. | 72 | 2011 |

Name | Principal Occupation | Age | Director Since |

| Nominees for election as Class III directors to continue in office until 2023 (Proposal One) | |||

| Tammy Moss Finley | Executive Vice President, General Counsel and Corporate Secretary, Advance Auto Parts, Inc. (automotive aftermarket parts provider), Roanoke, VA since May 2016. Executive Vice President, Human Resources, General Counsel and Corporate Secretary, Advance Auto Parts, Inc. from January 2015 to May 2016. Senior Vice President, Human Resources, Advance Auto Parts, Inc. from March 2013 to January 2015. Vice President, Employment Counsel and Government Affairs, Advance Auto Parts, Inc. from March 2010 to March 2013. Ms. Finley brings significant legal, human resource, retail, risk management, and public company corporate governance expertise from her multiple leadership roles at Advance Auto Parts as well as merger and acquisition experience. In addition, her close ties to the communities the Bank serves benefit the entire organization. | 53 | 2017 |

| Charles H. Majors | Chairman of the Board of Directors of the Company and the Bank since January 2015. Executive Chairman of the Company and the Bank from January 2013 to January 2015. Chairman and Chief Executive Officer of the Company and Chairman of the Bank from January 2012 to January 2013. President and Chief Executive Officer of the Company and Chairman and Chief Executive Officer of the Bank from June 2010 to January 2012. President and Chief Executive Officer of the Company and the Bank from 1994 to June 2010. Mr. Majors brings his long tenure and experience as the Chief Executive Officer of the Company. His prior experience as a practicing corporate attorney provides significant expertise in risk management, regulatory, and legal issues. | 74 | 1981 |

Nominees for election as Class III directors to serve until 2026 (Proposal One)

| |||

J. Nathan Duggins III | Managing Partner of Tuggle Duggins (law firm), Greensboro, NC since 2015.

Mr. Duggins brings an expert legal perspective as well as extensive experience in both real estate and privately-owned businesses. He has helped a large variety of clients with legal needs across a wide range of industries during his career as a practicing attorney in North Carolina since 1995. He served on the Company’s North Carolina State Banking Board and has been active in numerous community organizations in Greensboro and beyond, including the Guilford Education Alliance and the Guilford Merchants Association.

| 53 | 2022 |

William J. Farrell II | President of Berglund Automotive Group, Roanoke, VA since 2006.

Mr. Farrell is a veteran of the automotive industry and brings a keen business acumen. He is a former director of HomeTown Bank and HomeTown Bankshares Corporation (together, “HomeTown”) (acquired by the Company in 2019) and subsequently served on the Company’s Virginia State Banking Board. He is very involved in the Roanoke community, serving on the boards of the Virginia Western Educational Foundation, Visit Virginia’s Blue Ridge and the Virginia Automobile Dealers Association.

| 56 | 2022 |

Tammy Moss Finley | Executive Vice President, General Counsel and Corporate Secretary, Advance Auto Parts, Inc. (automotive aftermarket parts provider), Roanoke, VA since 2016. Executive Vice President, Human Resources, General Counsel and Corporate Secretary, Advance Auto Parts, Inc. from 2015 to 2016. Senior Vice President, Human Resources, Advance Auto Parts, Inc. from 2013 to 2015. Vice President, Employment Counsel and Government Affairs, Advance Auto Parts, Inc. from 2010 to 2013.

Ms. Finley brings significant legal, human resources, retail, risk management, and public company corporate governance expertise from her multiple leadership roles at Advance Auto Parts, as well as merger and acquisition experience. In addition, her close ties to the communities the Bank serves benefit the entire organization.

| 56 | 2017 |

Name | Principal Occupation | Age | Director Since |

| Dan M. Pleasant | Chief Operating Officer, The Dewberry Companies, Inc. (engineering, architectural and consulting), Fairfax, VA. Mr. Pleasant brings significant experience as a professional engineer working in the Company’s market areas in Virginia and North Carolina. In addition, he is the Chief Operating Officer of a large national architectural, engineering and consulting firm, currently leading the firm’s merger and acquisition program. He is currently a board member of the Virginia Economic Development Partnership and the Virginia Chamber of Commerce. | 69 | 2011 |

| Joel R. Shepherd | President, Virginia Home Furnishings, Inc. (furniture retailer) and 220 Self Storage, Inc. (self-storage provider), Rocky Mount, VA. A former chairman of Franklin Community Bank, N.A. and MainStreet BankShares, Inc. (acquired by the Company in 2015), Mr. Shepherd brings substantial entrepreneurial, construction, finance and management skills gained through his various enterprises. He also brings banking and investment experience. He was Vice President and Portfolio Manager in the Funds Management Division of Dominion Bankshares, Inc. (acquired by First Union Corporation, now part of Wells Fargo & Company) from 1986 to 1993. | 56 | 2015 |

| Directors of Class I to continue in office until 2021 | |||

Kenneth S. Bowling | Vice President, H.T. Bowling Inc. (heavy construction), Radford, VA. Mr. Bowling brings knowledge about the New River Valley market area where he has built a long-term successful construction business. As a former director of HomeTown Bank (acquired by the Company in 2019), he brings industry, governance, management and community bank experience to the Board. | 72 | 2019 |

Joel R. Shepherd | President, Virginia Home Furnishings, Inc. (furniture retailer) and 220 Self Storage, Inc. (self-storage provider), Rocky Mount, VA.

A former Chair of Franklin Community Bank, N.A. and MainStreet BankShares, Inc. (acquired by the Company in 2015), Mr. Shepherd brings substantial entrepreneurial, construction, finance and management skills gained through his various enterprises. He also brings banking and investment experience. He was Vice President and Portfolio Manager in the Funds Management Division of Dominion Bankshares, Inc. (acquired by First Union Corporation, now part of Wells Fargo & Company) from 1986 to 1993. He serves as a financial expert on the Company’s Audit Committee.

| 59 | 2015 |

Class I directors to remain in office until 2024

| |||

Michael P. Haley | Retired Adviser, Fenway Partners, LLC (private equity investments), New York, NY. Retired Managing Director, Fenway Resources since 2015. Adviser to Fenway Partners, LLC from 2006 and Managing Director of its affiliate, Fenway Resources, from 2008, respectively, to 2015.

Mr. Michael Haley brings high level financial expertise as a former Chief Executive Officer of a publicly traded manufacturing company and as a former adviser to a private equity firm. He also brings experience in operations and risk management and public company corporate governance. His background helps him fill the role of financial expert on the Company’s Audit Committee as well as to serve as Lead Independent Director.

| 72 | 2002 |

F. D. Hornaday, III | President and Chief Executive Officer, Knit Wear Fabrics, Inc. (circular knit manufacturer), Burlington, NC.

A former director and Vice Chair of MidCarolina Bank and MidCarolina Financial Corporation (together, “MidCarolina”) (acquired by the Company in 2011), Mr. Hornaday brings his multifaceted experience as President of a textile company, adding to the Board’s understanding of the challenges and opportunities facing manufacturing. In addition, his board service in the health industry and his former board service in the trust industry bring value to the Board. | 73 | 2011 |

Name | Principal Occupation | Age | Director Since |

| Michael P. Haley | Retired Adviser, Fenway Partners, LLC (private equity investments), New York, NY. Retired Managing Director, Fenway Resources since June 2015. Adviser to Fenway Partners, LLC from April 2006 and Managing Director of its affiliate, Fenway Resources from March 2008, respectively, to June 2015. Mr. Michael Haley brings high level financial expertise as a former Chief Executive Officer of a publicly traded manufacturing company and as a former adviser to a private equity firm. He also brings experience in operations and risk management and public company corporate governance. His background helps him fill the role of financial expert on the Company’s Audit Committee. | 69 | 2002 |

| Charles S. Harris | Executive Vice President, Averett University, Danville, VA. Mr. Harris brings significant operational and financial management experience, including as the Director of Athletics for several universities of various sizes, both public and private. He brings diversity and a different perspective from his work with college students, the future customers for the Bank. | 68 | 2008 |

| F. D. Hornaday, III | President and Chief Executive Officer, Knit Wear Fabrics, Inc. (circular knit manufacturer), Burlington, NC. A former director and vice chairman of MidCarolina Bank and MidCarolina Financial Corporation (“MidCarolina”) (acquired by the Company in 2011), Mr. Hornaday brings his multifaceted experience as President of a textile company, adding to the Board’s understanding of the challenges and opportunities facing manufacturing. In addition, his board service in the health industry and his former board service in the trust industry bring value to the Board. | 69 | 2011 |

Class II directors to remain in office until 2025

| |||

Nancy Howell Agee | President and Chief Executive Officer, Carilion Clinic (health care organization), Roanoke, VA.

A former director of HomeTown, Ms. Agee brings to the Board her leadership abilities, many years of service in the Bank’s Roanoke market area and significant knowledge and experience in finance and management as President and Chief Executive Officer of a large healthcare organization. She currently serves as director of two publicly traded companies and was formerly Chair of the American Hospital Association.

| 70 | 2019 |

Jeffrey V. Haley | President and Chief Executive Officer of the Company and the Bank since 2013. President of the Company and President and Chief Executive Officer of the Bank from 2012 to 2013. Executive Vice President of the Company and President of the Bank from 2010 to 2012. President of Trust and Financial Services and Executive Vice President of the Bank from 2008 to 2010.

Mr. Jeffrey Haley brings expertise based on more than 20 years in community banking and 16 years in the retail industry. His varied operational and management responsibilities during his banking tenure enable him to contribute a uniquely relevant perspective to the Board’s deliberations.

| 62 | 2012 |

John H. Love | President, Motor Carrier Insurance Educational Foundation, Fort Myers, FL since 2022. Co-founder and President, W.E. Love & Associates (insurance brokerage), Burlington, NC from 1993 to 2022.

A former director of MidCarolina, Mr. Love brings an expert perspective on risk management, mitigation and governmental regulation based on his experience as President of a large commercial insurance brokerage firm.

| 63 | 2011 |

Ronda M. Penn | Chief Financial Officer, Plexus Capital, LLC (small business investments), Raleigh, NC since 2012. Partner, Dixon Hughes Goodman LLP (public accounting), Greensboro, NC from 2006 to 2012.

Ms. Penn brings significant financial, accounting, internal control, investment and management expertise as a Chief Financial Officer, Certified Public Accountant and former partner with a national accounting firm. Her background helps her fill the role of financial expert on the Company’s Audit Committee as well as chair of that Committee. | 60 | 2015 |

Name | Principal Occupation | Age | Director Since |

| Directors of Class II to continue in office until 2022 | |||

| Nancy Howell Agee | President and Chief Executive Officer, Carilion Clinic (health care organization), Roanoke, VA. A former director of HomeTown Bank and HomeTown Bankshares Corporation (“HomeTown’) (acquired by the Company in 2019), Ms. Agee brings to the Board her leadership abilities, many years of service in the Bank’s Roanoke market area and significant knowledge and experience in finance and management as President and Chief Executive Officer of a large health care organization. She currently serves as immediate past Chair of the American Hospital Association and director of two publicly traded companies. | 67 | 2019 |

| Jeffrey V. Haley | President and Chief Executive Officer of the Company and the Bank since January 2013. President of the Company and President and Chief Executive Officer of the Bank from January 2012 to January 2013. Executive Vice President of the Company and President of the Bank from June 2010 to January 2012. President of Trust and Financial Services and Executive Vice President of the Bank from July 2008 to June 2010. Mr. Jeffrey Haley brings expertise based on more than 20 years in community banking and 16 years in the retail industry. His varied operational and management responsibilities during his banking tenure enable him to contribute a uniquely relevant perspective to the Board’s deliberations. | 59 | 2012 |

| John H. Love | President and Chief Operating Officer, W.E. Love & Associates, LLC (insurance brokerage), Burlington, NC since January 2018. President and Chief Executive Officer of W.E. Love & Associates, Inc. from December 2011 to January 2018. A former director of MidCarolina Bank and MidCarolina (acquired by the Company in 2011), Mr. Love brings an expert perspective on risk management, mitigation and governmental regulation based on his experience as President of a large commercial insurance brokerage firm. | 60 | 2011 |

Name | Principal Occupation | Age | Director Since |

| Ronda M. Penn | Chief Financial Officer, Plexus Capital LLC (small business investments), Raleigh, NC since September 2012. Partner, Dixon Hughes Goodman LLP (public accounting), Greensboro, NC from 2006 to September 2012. Mrs. Penn brings significant financial, accounting, internal control, investment and management expertise as a Chief Financial Officer, Certified Public Accountant and former partner with a national accounting firm. Her background helps her fill the role of financial expert on the Company’s Audit Committee. | 57 | 2015 |

| Susan K. Still | President of Virginia Banking of the Bank from April 2019 to December 2019. Director, President and Chief Executive Officer of HomeTown Bank and HomeTown (acquired by the Company in 2019) from May 2008 to March 2019. Ms. Still brings to the Board more than 40 years of banking experience in one of the Bank’s largest market areas. Her deep roots in the Roanoke community, thorough understanding of the banking industry and former Chief Executive Officer and director experience make her an asset to the Board. She served as a director of the Federal Reserve Bank of Richmond from January 1, 2016 until December 31, 2019. | 66 | 2019 |

Executive Officers

Information on the Company’s executive officers as of December 31, 20192022 who are not directors is disclosed in Part I, Item 1, of the Company’s Annual Report on Form 10-K for the year ended December 31, 2019,2022, which wasis being mailed with this proxy statement.

Board Independence

The Company’s Board of Directors has determined that, except for Ms. Still and Messrs. Majors andMr. Jeffrey Haley, each director is independent within the director independence standardstandards of the Nasdaq Stock Market LLC (“Nasdaq”), as currently in effect, and within the Company’s director independence standards, as established and monitored by the Company’s Corporate Governance and Nominating Committee.

Michael P. Haley is not related to Jeffrey V. Haley, President and Chief Executive Officer of the Company and the Bank. In order to avoid any confusion, Michael P. Haley will be referred to as Michael Haley and Jeffrey V. Haley will be referred to as Jeffrey Haley in this proxy statement.

Board Members Serving on Other Publicly Traded Company Boards of Directors

Ms. Agee has been a director of RGC Resources, Inc. since 2005 and Healthcare Realty Trust Incorporated since 2016. Michael Haley served as director of Stanley Furniture Company, Inc. from 2003 to 2017, Ply Gem Holdings, Inc. from 2006 to 2018 and LifePoint Health, Inc. from 2005 to 2018. LifePoint Health, Inc. was acquired by Apollo Global Management LLC in 2018 and he continues to serve as a director.

Board of Directors and Committees

Directors are expected to devote sufficient time, energy, and attention to ensure diligent performance of their duties, including attendance at board, committee, and shareholder meetings. The Board of Directors of the Company met 11 times during 2019.2022. The non-management directors held 11 executive sessions during 2019,2022, exclusive of the Chief Executive Officer and any other management. The ChairmanChair of the Board presides at such sessions. In accordance with the Company’s Corporate Governance Guidelines, the independent directors, exclusive of the Chairman of the Board and Chief Executive Officer, also held quarterly executive sessions during 2019. Prior to May 2019, the Chairman2022. The Chair of the Corporate Governance and Nominating Committee presided at such sessions. Since May 2019,Board or, in his absence, the Lead Independent Director presides at such session.sessions. The Board of Directors of the Bank, which consists of all members of the Company’s Board, met 11 times during 2019.

All incumbent directors and director nominees attended at least 80% of the aggregate total number of meetings of the Company's Boards of Directors and committees on which they served in 2019. Thirteen2022. Eleven directors attended the 20192022 Annual Meeting of Shareholders.

The Boards of Directors of the Company and the Bank have established various committees, including the Audit Committee, the Capital Management Committee, the Corporate Governance and Nominating Committee, the Human Resources and Compensation Committee, and the Risk and Compliance Committee. Membership and other information on these committees are detailed below.

The

Audit Committee met four times inThe

Capital Management Committee metThe Corporate Governance andNominating Committee met fourthree times in 2019.2022.This Committee currently consists of Ms. Agee and Messrs. Michael Haley, Hornaday, Owen, and Shepherd.Pleasant. Mr. OwenMichael Haley serves as the Chairman. Dr. Maddux also served as a Committee member until his resignation.Chair. The Committee is responsible for developing and implementing policies and practices relating to corporate governance, including reviewing and monitoring implementation of the Company’s Corporate Governance Guidelines. In addition, the Committee develops and reviews background information on candidates for the Board and makes recommendations to the Board regarding such candidates. The Committee also supervises the Board’s annual review of director independence, oversees the Board’s performance self-evaluation and makes recommendations to the Board of Directors regarding director compensation. All of the members of this Committee are considered independent within the meaning of SEC regulations, the listing standards of Nasdaq, and the Company’s Corporate Governance Guidelines.

The

Human Resources and Compensation Committee metThe

Risk and Compliance Committee met four times inThe charters of the Board Committees are available on the Company’s website, www.amnb.com. For access to the charters, select the “Investors” icon, then select “Governance Documents.”

Compensation Committee Interlocks and Insider Participation

No member of the Human Resources and Compensation Committee or executive officer of the Company has a relationship that would constitute an interlocking relationship with executive officers or directors of another entity.

Director Nominations Process

The Company’s Board of Directors has adopted, as a component of its Corporate Governance Guidelines, a process related to director nominations (the “Nominations Process”). The purpose of the

The Committee considers candidates for Board membership suggested by its members, other Board members, management, and shareholders. A shareholder who wishes to recommend a prospective nominee for the Board may, at any time, notify the Company’s Chairman,Chair, President or any member of the Committee in writing with supporting material the shareholder considers appropriate. The Committee will consider the shareholder’s recommendation and will decide whether to recommend to the Board the nomination of any person recommended by a shareholder pursuant to the provisions of the Company’s bylaws relating to shareholder proposals, as described in the “Shareholder Communications and Proposals” section of this proxy statement.

Once the Committee has identified a candidate, it makes an initial determination whether to conduct a full evaluation of the candidate based on information accompanying the recommendation and the Committee members’ knowledge of the candidate, which may be supplemented by inquiries to the person making such recommendation or to others. The preliminary determination is based primarily on the need for additional Board members to fill vacancies or expand the size of the Board and the likelihood that the candidate can satisfy the evaluation factors established in the Corporate Governance Guidelines. The Committee may seek additional information about the candidate’s background and experience. The Committee then evaluates the candidate against the criteria in the Company’s Corporate Governance Guidelines, including, but not limited to, independence, availability for time commitment, skills such as an understanding of the financial services industry, and general business knowledge and experience, all in the context of an assessment of the perceived needs of the Board at that point in time. The Committee does not have a formal policy with respect to diversity on the Board. However, it considers diversity as a prerequisite for adequately representing the interests of the various stakeholders in the Company – shareholders, customers, and employees. The Committee seeks diversity in overall board composition. In the Committee’s nominee considerations, diversity is a much broader concept than just the traditional racial and gender dimensions, as it also includes education, geography, business and professional experience and expertise, and civic involvement and responsibility, especially within the Company’s market area. In connection with this evaluation process, the Committee determines whether to interview the candidate, and if warranted, one or more members of the Committee will conduct such interview. After completing the evaluation, the Committee makes a recommendation to the Board of Directors as to the persons who should be nominated by the Board, and the Board determines the nominees after considering the recommendation of the Committee.

Corporate Governance and Risk Oversight Practices

In a financial institution, the role of the Board is critical to the success or failure of the enterprise. The Board of Directors ishas been led by the Company’s Chairman,Chair, Mr. Majors. Until May 2019, the ChairmanThe Chair of the Corporate Governance and Nominating Committee, Mr. Owen, functionedMichael Haley, has served as the Lead Independent Director. In May 2019, Mr. Michael Haley was named as Lead Independent Director. In such role, he chairschaired the Board in the absence of the ChairmanChair or the Chief Executive Officer or in the absence of the Chair when the Board’s independent directors meet in executive session. Mr. Michael Haley is a retired Chief Executive Officer of a publicly traded manufacturing company and a former adviser to a private equity firm, and his background and experience prepare him well for this role. Meetings

Effective at the conclusion of the independent directors are heldAnnual Meeting on May 16, 2023, Mr. Jeffrey Haley will assume the role of the Chair of the Boards of the Company and the Bank, while retaining the position of President and Chief Executive Officer of the Company and the Bank upon the retirement of Mr. Majors as a director and Chair. Also effective at least quarterly.

The Board of Directors of a financial institution is the strategic linchpin in the risk oversight process. Financial institutions deal with credit risk, liquidity risk, interest rate risk, investment risk, operational risk, reputation risk, regulatory risk, and technology and information security risk (including cybersecurity risk) in the day-to-day conduct of banking business. In order to better manage the risk oversight process, over the past few years, the Board has evolved and enhanced its supervision oversight process.

As part of that evolution, there are three standing Board committees whose focus is specifically risk management and oversight: the Audit Committee, the Capital Management Committee, and the Risk and Compliance Committee. The Audit Committee is primarily concerned with financial reporting and internal control related risks. The Capital Management Committee is primarily concerned with market risk, interest rate risk, liquidity risk, investment risk, and capital management. The Risk and Compliance Committee is primarily concerned with developing an enterprise wideenterprise-wide risk management strategy. Its focus is mainly operational, credit, regulatory compliance, and technology and information security risk (including cybersecurity risk). The Board’s Committee efforts are supplemented and supported by the Executive Risk Committee, which is comprised of members of senior management and the ChairmanChair of the Board.

In the opinion of the Board, this structure provides for a constantly evolving and improving approach to risk management and oversight. The Board believes the structure has served the interests of the shareholders, customers, employees and regulators well, as vouched by the Company’s consistently strong asset quality, earnings, and total return to shareholders.

Board Tenure Policy

The Board has a long-standing policy for the Company and the Bank with respect to the tenure of directors. This policy was revised and replaced by a newIn summary, the Directors’ Tenure Policy approved by the Board on December 17, 2019. In summary, it provides for the following:

• | Except as otherwise provided in the policy, the tenure of no director should extend beyond the Company’s Annual Meeting of Shareholders following the date on which such director reaches the age of 74; |

• | In furtherance of the policy, no director shall permit his or her name to be placed in nomination for reelection at the Annual Meeting of Shareholders following the date on which such director reaches the age of 72, except as follows: |

• | A director who has reached such age may be nominated and, if elected, may serve until the Annual Meeting of Shareholders following the date on which such director reaches the age of 74. At the time of nomination, such director shall submit to the Board a letter of resignation effective at such Annual Meeting of Shareholders. |

• | In order to provide continuity of leadership, a director serving as Chair of the Board may be nominated for one additional term of up to three years and, if elected, may serve until the earlier of (i) the end of such term or (ii) the date that such director is no longer serving as Chair. At the time of nomination, such director shall submit to the Board a letter of resignation effective upon the date that such director is no longer serving as Chair. |

• | The exceptions described above shall be made by the Board only upon recommendation of the Corporate Governance and Nominating Committee with an affirmative finding that such exceptions are in the best interest of the Company and the Bank; |

• | No director shall be nominated for reelection to the Bank Board of Directors unless, at the time of such reelection, he or she would be eligible to be a director of the Company; |

• | Any director who retires, resigns, or otherwise whose current employment is severed or who moves outside of the market area of the Bank, shall tender his or her resignation as a director. The Board may accept the resignation, delay acceptance, or decline to accept it; |

• | No director who is or was an officer of the Company and/or the Bank shall continue to serve as a director after retirement, resignation, or other severance of employment status. However, the Board may waive this requirement if it is deemed to be in the best interest of the Company and the Bank. |

Board Diversity

The Corporate Governance and Nominating Committee is committed to continuing to identify and recruit highly qualified director candidates with diverse experiences, perspectives, and backgrounds to join the Board of Directors.

Nasdaq Listing Rule 5605(f) requires each Nasdaq-listed company (1) to have at least one director who self-identifies as female, and (2) to have at least one director who self-identifies as an affirmative finding thatunderrepresented minority or as LGBTQ+, or (3) explain why it does not have at least two directors on its board who self-identify in such categories (the “Diverse Board Representation Rule”). In addition, Nasdaq Listing Rule 5606 requires each Nasdaq-listed company, subject to certain exceptions, areto publicly disclose statistical information on their board’s diversity in a uniform format. Full compliance with the best interestDiverse Board Representation Rule is not required until 2025.

The tables below provide certain information about the diversity of the Board in compliance with Nasdaq listing rules. This information is based on voluntary self-identification by each member of the Board. Mr. Charles S. Harris, a director of the Company and the Bank;

Board Diversity Matrix (As of March 28, 2023) | ||

Total Number of Directors | 12 | |

Female | Male | |

Part I: Gender Identity | ||

Directors | 4 | 8 |

Part II: Demographic Background | ||

African American or Black | - | - |

White | 4 | 7 |

Did Not Disclose Demographic Background | 1 | |

Board Diversity Matrix (As of March 28, 2022) | ||

Total Number of Directors | 12 | |

Female | Male | |

Part I: Gender Identity | ||

Directors | 4 | 8 |

Part II: Demographic Background | ||

African American or Black | - | 1 |

White | 4 | 6 |

Did Not Disclose Demographic Background | 1 | |

Environmental, Social and Governance (“ESG”) Considerations

The Company believes that a regional community bank is only as strong as the Board may waive this requirement ifcommunities it is deemedserves and has established the following core values to guide that service:

● | Relationship Focus |

Establishing trust based on respecting others and doing the right thing

● | Teamwork |

Working as one team, the Company values diverse perspectives to help move forward together

● | Reliability |

Fulfilling commitments through responsive communication and service

● | Constant Improvement |

The Company embraces change as it continually strives to be better

● | Authenticity |

Being genuine and practical in the best interestboth words and actions

The Company believes that commitment to ESG considerations is an important part of being a good corporate citizen and will help produce continued rewards for customers, employees and shareholders. The following are some highlights of the CompanyCompany’s efforts and the Bank; and

● | Environment – The Company has leveraged technology to limit in person meetings and allow more employees to work from home, thereby reducing energy consumption. The Company also makes every effort to ensure that hardware and other equipment that is no longer needed is sold for reuse or recycled to minimize waste. Furthermore, there is a Company-wide printer initiative underway to standardize and significantly reduce the number of printers and use of paper. The Company also encourages customers to utilize online banking and digital document delivery and vendors to provide paperless invoicing to lessen paper consumption. |

● | Financial Education – As a regional community bank, the Company takes its responsibility to provide financial education seriously and has partnered with select organizations to help improve financial literacy and consumer spending habits. Through its support of Banzai, the Company helps to provide free, schools-based financial education to K-12 youth. The Company is also an active part of the United Way of Roanoke Valley’s Bank On program and regularly participates in financial education programs through state banking associations, all of which ultimately improve the financial health of our communities. |

● | Access to Finance – The Bank announced on February 7, 2023 that its Clear Checking account was officially certified by the national Cities for Financial Empowerment Fund (CFE Fund) as meeting the Bank On National Account Standards (2023 – 2024). The Bank On designation ensures that consumers have access to safe and affordable financial products and services. |

● | Philanthropy – The Company has a long-standing commitment of supporting various not-for-profit organizations through sponsorship and donations. With so many worthy organizations, the Company prioritizes its support to those that serve local communities and are either a customer or an organization with which one of our employees is involved. For 2022, the Company set a goal of 1,500 community volunteer hours for its employees, who exceeded this by logging 2,097 volunteer hours supporting 90 not-for-profit organizations across 11 communities. Additionally, the Company’s donations and sponsorships totaled nearly $360 thousand in 2022. |

● | Small Business Lending – The Company was an ardent participant in the Small Business Administration’s Paycheck Protection Program (“PPP”). The Company processed over 3,000 loans totaling more than $360 million to support small businesses and their employees in the local communities the Company serves. |

● | Human Capital and Diversity, Equity and Inclusion – The Company is devoted to attracting and retaining banking professionals with diverse backgrounds and cultivating an inclusive work environment where everyone is treated with respect and dignity. Management has established a Diversity, Equity and Inclusion Committee to promote respect and fairness in the workplace. The Company’s commitment to help employees with financial, health, and personal wellness is demonstrated through its comprehensive set of benefits which includes 401(k) plans with generous employer matching contributions, an array of health, life, and disability insurance options, training and scholarship opportunities, and an employee assistance program. |

● | Governance – 11 of the 12 individuals currently serving on the Board of Directors are considered independent, including all members of the Audit Committee, Capital Management Committee, Corporate Governance and Nominating Committee, and Human Resources and Compensation Committee. The directors represent a wide-ranging mixture of backgrounds with regard to knowledge, experience and perspectives. The Board of Directors has adopted a Code of Conduct, which applies to all directors and employees of the Company and the Bank (see Code of Conduct section on page 38). The Company has a robust risk management framework with oversight provided by the Risk and Compliance Committee which focuses on operational, credit, regulatory compliance, and technology and information security (including cybersecurity) risk (see Corporate Governance and Risk Oversight Practices section on page 9). |

SECURITY OWNERSHIP

The table below includes information on all shareholders of the Company known to management to beneficially own 5% or more of the Company’s common stock.

| Name and Address of | Shares of Common Stock Beneficially Owned | Investment Power (1) | Voting Power (1) | Percent of Class | ||||||||||||||||||||||||

| Beneficial Owner | (#) (1) | Shared | Sole | None | Shared | Sole | None | (%) | ||||||||||||||||||||

| BlackRock, Inc. | 760,581 | — | 760,581 | — | — | 741,467 | — | 6.9% | ||||||||||||||||||||

| 55 East 52nd Street | ||||||||||||||||||||||||||||

| New York, New York 10055 (2) | ||||||||||||||||||||||||||||

Name and Address of | Shares of Common Stock Beneficially Owned | Investment Power (1) | Voting Power (1) | Percent of Class | ||||||||||||||||||||||||||||

Beneficial Owner | (#) (1) | Shared | Sole | None | Shared | Sole | None | (%) | ||||||||||||||||||||||||

BlackRock, Inc. | 740,744 | — | 740,744 | — | — | 729,013 | — | 7.0 | % | |||||||||||||||||||||||

55 East 52nd Street | ||||||||||||||||||||||||||||||||

New York, New York 10055 (2) | ||||||||||||||||||||||||||||||||

(1) | For purposes of this table, beneficial ownership has been determined in accordance with the provisions of Rule 13d-3 of the Securities Exchange Act of 1934 under which, in general, a person or entity is deemed to be the beneficial owner of a security if he or it has or shares the power to vote or direct the voting of the security or the power to dispose of or direct the disposition of the security, or if he or it has the right to acquire beneficial ownership of the security within 60 days. | |

(2) | This information is based solely upon information as of December 31, |

The following table sets forth, as of March 31, 2020,28, 2023, the Annual Meeting record date, the beneficial ownership of the Company’s common stock by all directors and nominees for director, all executive officers of the Company named in the Summary Compensation Table on page 3223 of this proxy statement, and all current directors and executive officers of the Company as a group.

| Name of Beneficial Owner | Shares of Common Stock Beneficially Owned (#) (1) | Percent of Class (%) | ||||

| Nancy Howell Agee | 15,162 | * | ||||

| Kenneth S. Bowling | 13,386 | * | ||||

| Jeffrey W. Farrar | 2,997 | (2) | * | |||

| Tammy Moss Finley | 4,559 | * | ||||

| Jeffrey V. Haley | 62,462 | (2) | (3) | * | ||

| Michael P. Haley | 18,617 | (4) | * | |||

| Charles S. Harris | 9,479 | * | ||||

| F. D. Hornaday, III | 30,746 | (3) | * | |||

| John H. Love | 25,829 | * | ||||

| Charles H. Majors | 59,140 | (3) | * | |||

| Edward C. Martin | 3,472 | (2) | * | |||

| Claude B. Owen, Jr. | 32,764 | (3) | * | |||

| Ronda M. Penn | 6,854 | * | ||||

| Dan M. Pleasant | 26,463 | (4) | * | |||

| Joel R. Shepherd | 70,703 | (3) | (4) | * | ||

| John H. Settle, Jr. | 3,546 | (2) | * | |||

| Susan K. Still | 10,512 | * | ||||

| H. Gregg Strader | 20,572 | (2) | * | |||

| William W. Traynham | 29,824 | (2) | * | |||

| All directors and executive officers as a group (19) | 447,087 | (5) | 4.08 | |||

Name of Beneficial Owner | Shares of Common Stock Beneficially Owned (#) (1) | Percent of Class | ||||||

Nancy Howell Agee | 21,433 | (2 | ) | * | ||||

J. Nathan Duggins III | 2,873 | (2 | ) | * | ||||

Jeffrey W. Farrar | 10,286 | (3 | ) | * | ||||

William J. Farrell II | 1,026 | * | ||||||

Tammy Moss Finley | 11,408 | (2 | ) | * | ||||

Jeffrey V. Haley | 85,066 | (2 | )(3) | * | ||||

Michael P. Haley | 27,885 | (4 | ) | * | ||||

F. D. Hornaday, III | 38,666 | (2 | ) | * | ||||

Rhonda P. Joyce | 17,410 | (2 | )(3) | * | ||||

Alexander Jung | 5,476 | (3 | ) | * | ||||

John H. Love | 32,168 | * | ||||||

Charles H. Majors | 59,140 | (2 | ) | * | ||||

Edward C. Martin | 11,908 | (2 | )(3) | * | ||||

Ronda M. Penn | 14,025 | * | ||||||

Dan M. Pleasant | 35,400 | (2 | )(4) | * | ||||

Joel R. Shepherd | 77,994 | (2 | )(4) | * | ||||

All directors and executive officers as a group (16) | 452,164 | (5 | ) | 4.26 | ||||

| * | Represents less than 1% ownership. | |

(1) | For purposes of this table, beneficial ownership has been determined in accordance with the provisions of Rule 13d-3 of the Securities Exchange Act of 1934 under which, in general, a person is deemed to be the beneficial owner of a security if he or she has or shares the power to vote or direct the voting of the security or the power to dispose of or direct the disposition of the security, or if he or she has the right to acquire beneficial ownership of the security within 60 days. |

(2) |

Includes shares held by affiliated companies, close relatives, minor children, and shares held jointly with spouses or as custodians or trustees, as follows: Ms. Agee, 3,452 shares; Mr. Duggins, 1,150 shares; Ms. Finley, 1,074 shares; Mr. Jeffrey Haley, |

(3) | Includes shares of restricted stock awarded, as follows: Mr. Farrar, 9,286 shares; Mr. Jeffrey Haley, 55,556 shares; Ms. Joyce, 13,168 shares; Mr. Jung, 5,476 shares; Mr. Martin, 10,784 shares; and all executive officers as a group, 94,270 shares. The shares are subject to a vesting schedule, forfeiture risk and other restrictions. These shares can be voted at the Annual Meeting. |

(4) | Includes stock awards held under a nonqualified deferred compensation plan for directors, as follows: Mr. Michael Haley, 9,809 shares; Mr. Pleasant, 8,877 shares; and Mr. Shepherd, 3,258 shares. These shares cannot be voted at the Annual Meeting. |

(5) | None of the individuals named in the table have pledged their shares as collateral. |

COMPENSATION COMMITTEE REPORT

The Human Resources and Compensation Committee of the Board of Directors has reviewed and discussed with the Board and management the Company’s Compensation Discussion and Analysis. Based upon this review and discussion, the Committee recommended to the Board of Directors that the Compensation Discussion and Analysis be included in the Company’s definitive proxy statement on Schedule 14A for the Annual Meeting, portions of which are incorporated by reference in the Company’s Annual Report on Form 10-K for the fiscal year ended December 31, 2019,2022 as filed with the SEC.

| Respectfully submitted, | |

| Dan M. Pleasant, Chair | |

| Tammy Moss Finley | |

| Michael P. Haley | |

| John H. Love |

COMPENSATION DISCUSSION AND ANALYSIS

Introduction

The Company’s Executive Compensation Philosophy

The Human Resources and Compensation Committee of the Board of Directors (the “Committee”) is responsible for establishing and approving the compensation of the executive officers of the Company, except for the compensation of the Chief Executive Officer, which is approved by the independent members of the Board of Directors. The Committee considers a variety of factors and criteria in arriving at its decisions and recommendations for compensation. The Committee’s objective is to attract and retain a superb leadership team with market-competitive compensation and to align the team member’smembers’ interests with those of the Company, its customers and its shareholders. Accordingly, a significant portion of the Company’s executive officers’ compensation is directly and materially linked to operating performance. In particular, cashCash incentive payments and restricted stock awards are heavily dependent on meeting or exceeding Company financial performance goals as well as objective and subjective criteria related to the executive

Each director who served on the Committee during 20192022 qualifies as a “non-employee director” as such term is defined in Rule 16b-3 promulgated under the Securities Exchange Act of 1934 and is an “independent director” as such term is defined in Nasdaq Marketplace Rule 5605(a)(2).

The Committee considers the results of the shareholder advisory say-on-pay vote in its deliberations regarding compensation of the named executive officers. At the Company’s 20192022 Annual Meeting, 95.5%

Named Executive Officers

This Compensation Discussion and Analysis section describes the Company’s 20192022 executive compensation programs and decisions with respect to the Company’s executive officers and, in particular, each executive officer named in the Summary Compensation Table on page 32 (the “named executive officers” or “NEOs”). In 2019,2022, our named executive officers were:

Named Executive Officers | Principal Position During | Years of Service | |||

Jeffrey V. Haley | President and Chief Executive Officer of the Company and the Bank | 26 | |||

Jeffrey W. Farrar | Senior Executive Vice President and Chief Operating and Chief Financial Officer of the Company and the Bank | 4 | |||

Edward C. Martin | Senior Executive Vice President and Chief the Company and the Bank and President of Virginia Banking | 7 | |||

Rhonda P. Joyce | Executive Vice President and | 12 | |||

Alexander Jung | Executive Vice President and | ||||

| 1 | ||

Role of Compensation Consultant

The Committee retained the services of Pearl Meyer & Partners, LLC (“PM&P”), an independent executive compensation consulting firm, during 2021 to provide consulting services in connection with conducting a competitive compensation review with respect to the organization’s executive management

The 2021 compensation review encompassed (i) the development of a custom peer group consisting of community banks of comparable size in Virginia and contiguous states, publicly traded, with assets between $1.2$2.2 billion and $3$6.1 billion; (ii) an assessment of the Company’s executive compensation as compared to market (similar executives in the peer group); (iii) a high level assessment of the Company’s performance relative to peers; and (iv) establishing a basis for discussing potential pay or other compensation changes in future periods.

The 20172021 custom peer group of comparable community banks consisted of the following institutions:

Institution Name | Ticker | State |

Stock Yards Bancorp, Inc. | SYBT | KY |

City Holding Co. | CHCO | WV |

Community Trust Bancorp, Inc. | CTBI | KY |

CNB Financial Corp. | CCNE | PA |

Peoples Bancorp Inc. | PEBO | OH |

SmartFinancial Inc. | SMBK | TN |

HomeTrust Bancshares Inc. | HTBI | NC |

Mid Penn Bancorp Inc. | MPB | PA |

Primis Financial Corp. | FRST | VA |

Summit Financial Group Inc. | SMMF | WV |

Capstar Financial Holdings Inc. | CSTR | TN |

First Community Bancshares, Inc. | FCBC | VA |

Orrstown Financial Services | ORRF | PA |

Southern First Bancshares, Inc. | SFST | SC |

MetroCity Bankshares Inc. | MCBS | GA |

Codorus Valley Bancorp Inc. | CVLY | PA |

The Community Financial Corporation | TCFC | MD |

C&F Financial Corporation | CFFI | VA |

The PM&P review in 20172021 determined that overall base salaries provided to executive management approximated 102% of the 75th percentile and 122%98% of the market median.median and were competitive with the market. The review further determined that total direct compensation (total cash plus equity awards) approximated 88% of the 75% percentile and 106%84% of the market median. The Committee determined that, due to the high performance of the Company, it is desired that salariesmedian and total compensation for the Company’s executive officers should be in the range of 75% of the markets; therefore, PM&P considered 2017 compensation levelswere again competitive with the market.market within a tolerance. The Board of Directors, the Committee, and the Chief Executive Officer considered this information as part of their decision makingdecision-making process on current executive compensation levels.

During 2017,2021, PM&P reported directly to the Committee.Committee and did not provide any other services to the Company. In 2017,2019, the Corporate Governance and Nominating Committee also engaged PM&P to provide a peer comparison of director compensation. At that time,In 2021, the Committee analyzed whether the work of PM&P raised any conflicts of interest, taking into consideration the following factors, among others: (i) the provision of other services to the Company by PM&P; (ii) the amount of fees from the Company paid to PM&P as a percentage of PM&P’s total revenues; (iii) PM&P’s policies and procedures that are designed to prevent conflicts of interest; (iv) any business or personal relationship of PM&P or the individual compensation advisors employed by PM&P with an executive officer of the Company; (v) any business or personal relationship of the individual compensation advisors with any member of the Committee; and (vi) any stock of the Company owned by PM&P or the individual compensation advisors employed by PM&P. The Committee determined, based on its analysis of the above factors, among others, that the work of PM&P and the individual compensation advisors employed by PM&P as compensation consultants or advisors to the Company did not create any conflicts of interest.

Salary

The base salary of each named executive officer is designed to be competitive with that of the Company’s peer banks and bank holding companies. In establishing the base salaries for the named executive officers in 2019,2022, the Committee and Board relied upon an evaluation of each officer’s level of responsibility and performance. The Committee and the independent members of the Board of Directors also took into account the information described above that was provided by PM&P, including the peer group data. In establishing the base salary for the executive officers other than the Chief Executive Officer, the Committee also received and took into account the individual compensation recommendations of the Chief Executive Officer. In executive session, the independent directors collectively evaluated the performance of the Chief Executive Officer and considered whether his performance benefited the Company’s shareholders. The ChairmanChair of the Committee met with the Chief Executive Officer to review the results of the evaluation after the CommitteeCommittee’s discussion. The 20192022 salary of the Chief Executive Officer was ultimately reviewed, discussed, and approved by the independent members of the Board of Directors in executive session, upon recommendation of the Committee.

Performance Compensation and Bonus Program

Pursuant to the terms of the incentive program established for the Company’s named executive officers, the officers had the opportunity to earn incentive payments for 20192022 performance, with the targeted payout for the Chief Executive Officer set at $220,000an amount equal to 55% of his base salary, and the targeted payout for each of the other named executive officers set at an amount equal to a range of 25% to 30%50% of their respective base salaries. For 2022, for the Chief Executive Officer and each of the other named executive officers targeted incentive payment was entirely based primarily on the achievement of goals based ona singular corporate goal of core earnings per share (“Core EPS”). For, defined as net income per diluted share, per generally accepted accounting principles, less the other named executive officers, 50%impact of the targeted incentive payment was based onfair value and merger related adjustments, and earnings associated with PPP. The achievement of certain position specific objectiveindividual non-financial operational goals and the other 50% was based on the achievement of certain goals based on core EPS.also considered. Incentive payments are normally made in a combination of cash and restricted stock grants, with the percentage mix established by the Committee in its sole discretion. The participants have the option of taking a larger percentage of the bonus payment in restricted stock and less in cash.

The financial target and thresholds to activate incentive compensation payments for 2022 performance are outlined below:

Corporate Performance Measure | Weighting | Threshold | Target | Maximum | ||||||||||||

Core EPS | 100 | % | $ | 2.88 | $ | 3.00 | $ | 3.12 | ||||||||

The actual Core EPS achieved for 2022 was a certain level$3.17, which exceeded the maximum threshold of core net income (defined as net income,$3.12 per generally accepted accounting principles, less the impact of fair value and merger related adjustments) on an EPS

For the Chief Executive Officer, the targeted coreCore EPS was $2.75, whichof $3.00 would resulthave resulted in eligibility for a $316,250 incentive compensation payment, in a $220,000 incentive payment.combination of cash and restricted stock grants. The minimum threshold was $2.67 in core EPS, which would result in a $110,000 payment. The maximum threshold was $2.86 in core EPS, which would result in a $330,000 payment. For 2019, the Company's core EPS of $2.77 resulted into receive an incentive payment to Mr. Jeffrey Haley(Core EPS of $120,000 with respect$2.88) would have resulted in a $158,125 payment eligibility, and the maximum threshold (Core EPS of $3.12) would have resulted in a $474,375 payment eligibility. As discussed above, the Core EPS was above the maximum threshold, resulting in a total incentive payment to the cash component and 3,217 shares of common stock (grant date market value of $120,000) with respect to the stock component. For 2020, the incentive program methodology will remain the same for the Chief Executive Officer butof 82.5% of his base salary, or $474,375, divided as equally as practicable into cash of $237,188 and a stock award of 6,504 shares with a different target and thresholds.

For each of the named executive officers other than the Chief Executive Officer, the targeted coreCore EPS of $2.75$3.00 would resulthave resulted in a target incentive payment equal to 30%50% of the respective base salaries for Messrs. Farrar, StraderMartin Jung, and Traynham, and a target incentive payment equal to 25% of the respective base salaries for Messrs. Martin and Settle.Ms. Joyce. The target payment would decreasehave decreased or increased proportionately if coreCore EPS was under budget and increase proportionately if coreeither less than the target to a minimum Core EPS exceeded budget, withof $2.88 or more than the target to a maximum of 37.5%Core EPS of $3.12. The maximum incentive payment eligibility, in combination of cash and restricted stock grants, for 2022 was 75% of base salary for Messrs. Farrar, StraderMartin, Jung, and Traynham and 31.25% for Messrs. Martin and Settle. Also in 2019, theMs. Joyce. The cash payments and restricted stock grants under the incentive program becamecontinued to be subject to achievement of individual non-financial operational goals in addition to coreCore EPS.

As discussed above, the Core EPS which were achieved. For 2020,was above the maximum threshold for incentive program methodology will remainpayment eligibility under the same for these officers, but with different targetsprogram. Accordingly, Messrs. Farrar, Martin, Jung, and thresholds.

Beginning in 2015, certain named executive officers became eligible to participate in a voluntary, nonqualified deferred compensation plan pursuant to which the officers may defer any portion of their annual cash incentive payments. The only eligible executive officersofficer for 2019 were Messrs.2022 was Mr. Jeffrey Haley, Strader and Traynham.Haley. In addition, the Company may make discretionary cash bonus contributions to the deferred compensation plan. Such contributions, if any, are made on an annual basis after the Committee assesses the performance of each of the named executive officers and the Company during the most recently completed fiscal year. The goal of the Committee is to award such discretionary bonus payments

In the opinion of the Committee and the Board of Directors, the Company’s compensation practices do not encourage excessive or inappropriate risk taking and are not reasonably likely to have a material adverse effect on the Company, but rather will have a positive effect on the Company.

Equity Compensation Plan

The Company maintains the American National Bankshares Inc. 2018 Equity Compensation Plan (“2018 Plan”), which was designed to attract and retain qualified key personnel, provide employees with a proprietary interest in the Company as an incentive to contribute to the success of the Company, and reward employees for outstanding performance and the attainment of goals. The 2018 Plan was adopted by the Board of Directors of the Company on February 20, 2018, approved by the shareholders on May 15, 2018 at the Company’s 2018 Annual Meeting and expires on February 19, 2028. The 2018 Plan provides for the granting of restricted stock awards, incentive and non-statutory stock options, restricted stock units and other stock-based awards to employees and directors, at the discretion of the Board or a Board designated committee. The 2018 Plan prohibits the payment of dividends or similar distributions on awards, whether subject to time-based or performance-based vesting, unless and until the vesting requirements have been met, and prohibits share recycling. The 2018 Plan authorizes the issuance of up to 675,000 shares of common stock and replaced the Company’s 2008 Stock Incentive Plan (“2008 Plan”) that expired February 18, 2018.

The 2018 Plan is administered by the Committee. Under the 2018 Plan, the Committee determines which employees will be granted restricted stock awards, other stock-based awards and options, whether such options will be incentive or non-statutory options, the number of shares subject to each option, whether such options will be exercised by delivering other shares of common stock, and when such options become vested and exercisable. In general, the per share exercise price of an incentive stock option must be at least equal to the fair market value of a share of common stock on the date the option is granted. Restricted stock is granted under terms and conditions established by the Committee.

Stock options become vested and exercisable in the manner specified by the Committee. Each stock option or portion thereof is exercisable at any time on or after it vests and is exercisable until ten years after its date of grant. No stock options have beencan be backdated or repriced. As of December 31, 2019,2022, options for 13,9444,150 shares are exercisable, all of which were granted under HomeTown Bank’s 2005

The Company from time-to-time grants shares of restricted stock under the 2018 Plan to key employees and non-employee directors. The Company believes the awards help align the interests of these employees and directors with the interests of the shareholders of the Company by providing economic value directly related to increases in the value of the Company’s common stock. The value of the stock awarded is based on the fair market value of the Company’s common stock at the time of the grant, which is the closing price of the stock on the Nasdaq Global Select Market on the grant date. The Company recognizes expense, equal to the total value of such awards, proportionately over the vesting period of the stock grants.

The currenttime-based grants of restricted stock do not have performance conditions that must be satisfied in order for the shares to be earned and vest either at or ratably over 36 months after the award date, contingent on continuous service though the applicable vesting date. On January 21, 2020,18, 2022, the Company awarded an aggregate of 18,63031,753 shares of restricted stock to the named executive officers and 3619 other senior officerskey employees of the Bank.

Unvested restricted stock for the year ended December 31, 20192022 is summarized in the following table.

| Restricted Stock | Shares | Weighted Average Grant Date Value | ||

| Unvested at January 1, 2019 | 52,798 | $31.71 | ||

| Replacement stock awards | 7,137 | $27.28 | ||

| Granted | 22,274 | $32.79 | ||

| Vested | (23,572) | $23.70 | ||

| Forfeited | (1,366) | $33.22 | ||

| Unvested at December 31, 2019 | 57,271 | $34.84 | ||

Restricted Stock | Shares | Weighted Average Grant Date Value | ||||||

Unvested at January 1, 2022 | 58,461 | $ | 31.71 | |||||

Granted | 33,363 | $ | 35.18 | |||||

Vested | (18,370 | ) | $ | 31.23 | ||||

Forfeited | (1,747 | ) | $ | 34.12 | ||||

Unvested at December 31, 2022 | 71,707 | $ | 33.39 | |||||

As of December 31, 2019,2022, total unrecognized compensation cost related to unvested restricted stock granted under the 2008 Plan and the 2018 Plan amounted to $751,000.$1.1 million. This cost is expected to be recognized over the next 12 to 36 months.

Retirement Plan

Through December 31, 2009, the Company’s retirement plan was a non-contributory defined benefit pension plan that covered all full-time employees of the Company who were 21 years of age or older and who had at least one year of service. Advanced funding of the plan was accomplished by using the actuarial cost method known as the “collective aggregate cost method”.

The plan was closed to new participants at December 31, 2009. On that date, the Company converted the plan to a cash balance plan. Participant balances at that date reflected the net present value of the plan’s then existing obligation to the participants. Beginning January 1, 2010, participants earn income each year based on the ten-year U.S. Treasury note yield established at December 31 of the prior year, subject to certain adjustments.

401(k) Employee Savings Plan

The Company sponsors a 401(k) Employee Savings Plan in which all full-time employees (age 21 and older) are eligible to participate. The Company matches 100% of employee contributions on the first 3% of earned compensation and 50% of employee contributions of the second 3% of earned compensation. Perquisites received by executive officers are not included as earned compensation under this plan. The Company’s contributions are not subject to a vesting schedule.

Perquisites

Due to the geographic size of the Company’s market area, in 20192022 the Company provided the Chief Executive Officer and the Chief Banking Officer with an automobile and reimbursed themhim for the cost of fuel and maintenance for the vehiclesvehicle other than the estimated amount of personal use of the vehicles.vehicle. In 2020,2023, such arrangement will continue for the Chief Executive Officer and the Chief Banking Officer.continue. There is no tax gross-up provided by the Company for any employee perquisites.

Other Benefit Plans

Executive officers participate in the Company’s benefit plans on the same terms as other employees. These plans include medical, dental, life, and disability insurance. The Company provides life insurance coverage equal to four times the employee’s salary for all eligible employees. Coverage in excess of $50,000 is subject to taxation paid by the employee based on Internal Revenue Service guidelines.

Executive Employment Agreements and Change in Control Arrangements

The Company recognizes that, as a publicly held financial services company, it is imperative that it maintain stability and continuity in its executive management positions. The Company also understands that the possibility of a change in control of the Company exists. In order to protect the interests of the shareholders and the Company, to promote continuity in the event of a change in control and to minimize uncertainty among executive management, the Company and its executive officers have entered into employment agreements that contain severance arrangements in connection with a change in control of the Company. All named executive officers currently have operative employment agreements, other than Mr. Traynham, who retired froma summary of which is provided below.

On March 1, 2022, the Company on October 31, 2019.

Mr. Jeffrey Haley’s agreement renewshas an initial term of three years from its effective date, January 1, 2022, and expires on December 31, 2024, provided that on and after January 1, 2023, the term of the agreement will be automatically extended on a daily basis by one day so that the term of employmentthere will always hasbe at least two years to run. Effectiveremaining in the term of the agreement upon such extension. Each agreement for Messrs. Farrar, Martin, and Jung, and Ms. Joyce has an initial term of two years from its effective date, January 1, 2017,2022, and expires on December 31, 2023, provided that on and after January 1, 2023, the term of the agreement for Mr. Strader renewswill be automatically extended on a daily basis by one day so that the term of employmentthere will always hasbe at least one year to run. Effective August 5, 2021, Mr. Farrar’s agreement renews automatically on a daily basis so thatremaining in the term of employment always hasthe agreement upon such extension. The Company may give each of the officers notice of nonrenewal of their respective agreements at leastany time on or after January 1, 2023, and Mr. Jeffrey Haley’s agreement will terminate two years after the date of such notice and Messrs. Farrar, Martin, and Jung, and Ms. Joyce’s agreements will terminate one year to run. Effective January 1, 2019, Mr. Martin’s agreement renews automatically on a daily basis so thatafter the termdate of employment always has at least one year to run. Effective November 1, 2018, Mr. Settle’s agreement renews automatically on a daily basis so thatsuch notice. Each of the term of employment always has at least one year to run. Each agreement willagreements automatically terminate on the first day of the month immediately following the month in which the officer turns 70.